One Billion Crypto Users until 2030?

7/23/2022, 05:47 PM

The Boston Consulting Group (BCG) has released a new report predicting that North America will lead the world in cryptocurrency adoption by 2030, stating that they the number of crypto users will increase to 1 billion by 2030.

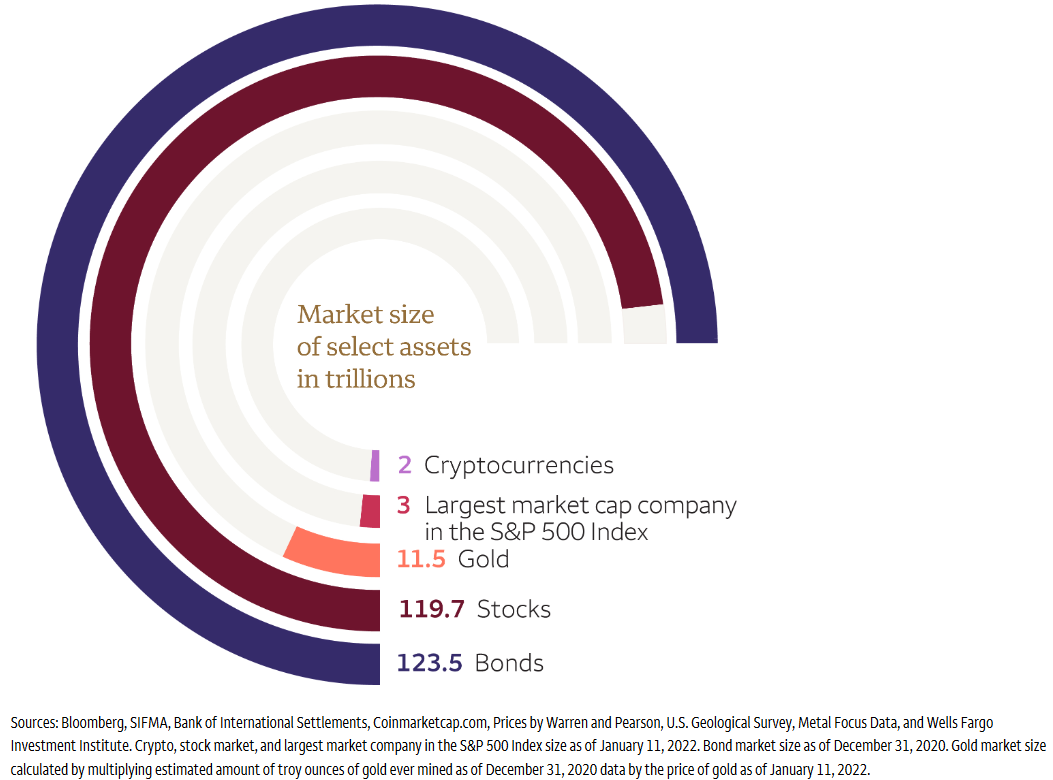

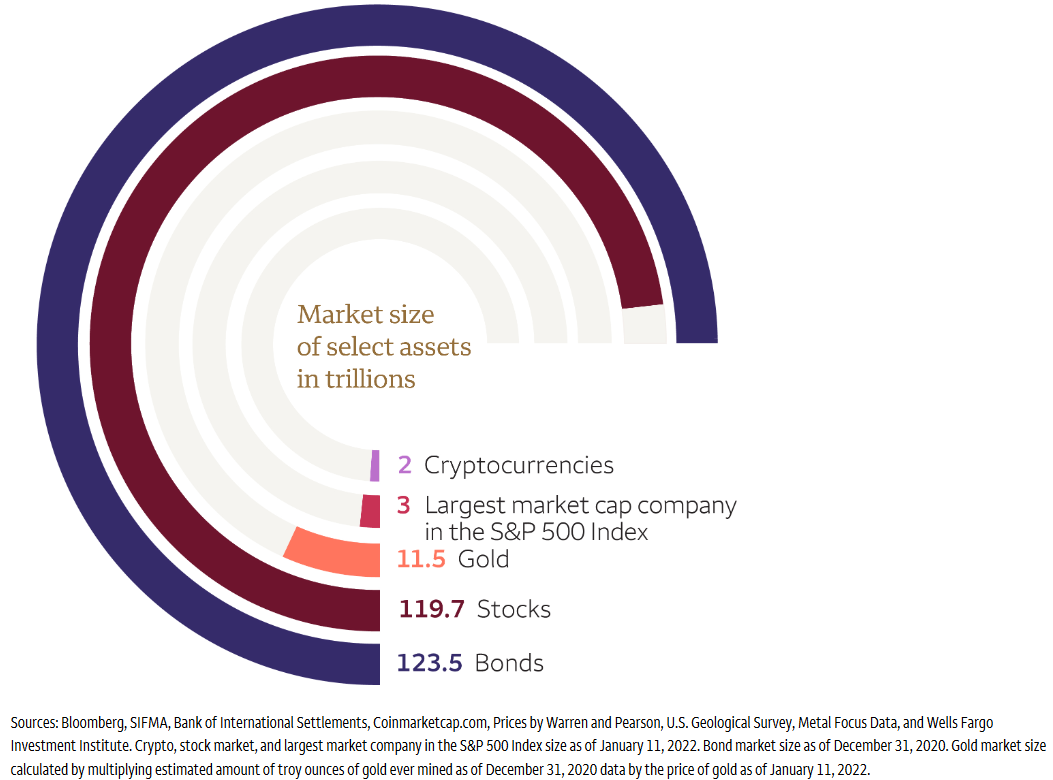

The report cites the growth of the internet in the 1990s as an analogous example of the potential for cryptocurrency adoption. It notes that the number of crypto applications has increased from 800 to 10,000 in the past five years, and that initial coin offerings (ICOs) have boomed in recent years. However, it also notes that traditional investments still far outstrip cryptocurrency investments, with only 0.3% of users' overall wealth held in crypto.

As the crypto industry continues to grow, so does the need for more exchanges to meet the demand of users. BCG predicts that North America will lead the way in crypto adoption by 2030, with the average user holding $18,000 in crypto assets. This is a significant increase from the 0.3% of users' overall wealth that is currently held in crypto.

Payments provider MasterCard is looking to make it possible to make purchases in cryptocurrency directly without conversion to fiat money. This would be a major step forward in the adoption of crypto as a mainstream currency.

Banks are also getting involved in the crypto space. JPMorgan Chase bank pioneered a BTC fund and is working on developing blockchain assets. Morgan Stanley started offering wealth-management clients exposure to bitcoin funds in March 2021. This shows that the traditional financial world is starting to take crypto seriously as an investment opportunity.

Exchanges are critical drivers of crypto adoption and have undergone consolidation phases in order to establish themselves in countries with reduced costs. Aggressive Mergers and Acquisitions strategies have seen major offshore exchanges like FTX move onshore in developed countries. Companies like Binance have the potential to supplant local exchanges due to their agile product development and robust platforms.

Exchanges are critical drivers of crypto adoption and have undergone consolidation phases in order to establish themselves in countries with reduced costs. Aggressive Mergers and Acquisitions strategies have seen major offshore exchanges like FTX move onshore in developed countries. Companies like Binance have the potential to supplant local exchanges due to their agile product development and robust platforms.

FTX is awaiting approval from the Commodities and Futures Trading Commission to offer disintermediated trades for derivatives products as it seeks to expand its footprint in the U.S.A. This shows that the crypto industry is continuing to grow and evolve, with more exchanges popping up to meet the demand of users.

For first hand data check their homepage: https://www.bcg.com

Or read the full report yourself: PDF Report

The report cites the growth of the internet in the 1990s as an analogous example of the potential for cryptocurrency adoption. It notes that the number of crypto applications has increased from 800 to 10,000 in the past five years, and that initial coin offerings (ICOs) have boomed in recent years. However, it also notes that traditional investments still far outstrip cryptocurrency investments, with only 0.3% of users' overall wealth held in crypto.

As the crypto industry continues to grow, so does the need for more exchanges to meet the demand of users. BCG predicts that North America will lead the way in crypto adoption by 2030, with the average user holding $18,000 in crypto assets. This is a significant increase from the 0.3% of users' overall wealth that is currently held in crypto.

Institutional investors are starting to take notice of the potential of crypto. Between the fourth quarter of 2020 and the end of 2021, institutional crypto investment totaled $70 billion. This is a significant increase from the 0.3% of users' overall wealth that is currently held in crypto.If we use the number of cryptocurrency holders as a proxy for Web3 users, and benchmark it against the adoption rate of Internet users in the 1990s, the message is clear: there is plenty of growth to come. While it is difficult to predict if the trendline of crypto adoption continues, the total number of crypto users is likely to reach 1 billion by 2030- Boston Consulting Group

Payments provider MasterCard is looking to make it possible to make purchases in cryptocurrency directly without conversion to fiat money. This would be a major step forward in the adoption of crypto as a mainstream currency.

Banks are also getting involved in the crypto space. JPMorgan Chase bank pioneered a BTC fund and is working on developing blockchain assets. Morgan Stanley started offering wealth-management clients exposure to bitcoin funds in March 2021. This shows that the traditional financial world is starting to take crypto seriously as an investment opportunity.

Exchanges are critical drivers of crypto adoption and have undergone consolidation phases in order to establish themselves in countries with reduced costs. Aggressive Mergers and Acquisitions strategies have seen major offshore exchanges like FTX move onshore in developed countries. Companies like Binance have the potential to supplant local exchanges due to their agile product development and robust platforms.

Exchanges are critical drivers of crypto adoption and have undergone consolidation phases in order to establish themselves in countries with reduced costs. Aggressive Mergers and Acquisitions strategies have seen major offshore exchanges like FTX move onshore in developed countries. Companies like Binance have the potential to supplant local exchanges due to their agile product development and robust platforms.FTX is awaiting approval from the Commodities and Futures Trading Commission to offer disintermediated trades for derivatives products as it seeks to expand its footprint in the U.S.A. This shows that the crypto industry is continuing to grow and evolve, with more exchanges popping up to meet the demand of users.

For first hand data check their homepage: https://www.bcg.com

Or read the full report yourself: PDF Report