Many landmark events in the coming crypto week

7/25/2022, 05:18 PM

The global financial market is eagerly awaiting the announcement of interest rates by the US Federal Reserve in the middle of the week. While the cryptocurrency Bitcoin (BTC) was able to recover to the price of 24,200 US dollars last week despite mostly weak economic data, the BTC price is now falling back to the important support level at 21,800 US dollars.

In addition to the interest rate decision and relevant economic data such as the gross domestic product (GDP) of the USA and the consumer price index (CPI) for the Eurozone, the quarterly results of large US technology companies such as Meta and Alphabet will again be in focus this week. Whether the positive price development of the previous week will continue this trading week will again depend largely on economic data.

You can find out which dates could affect the prices of Bitcoin and Co. in this trading week in the following.

The earnings reports of Microsoft and Alphabet (Google) on Tuesday will provide valuable insights into current demand in the information technology sector. In particular, the outlooks for the next set of earnings in the second half of the year will give clues about future global economic development. In the middle of the week, Zuckerberg's company Meta will open its books to investors.

Here too, investors are hoping for new insights into the scope of advertising placed on the various social media platforms of the company. On Thursday, Amazon will release its quarterly results. declining sales at the largest online retailer would also indicate an ongoing economic downturn.

The relevant fundamental data for the start of the week is the Consumer Confidence data from the USA. This data is used to reflect the optimism of consumers in the USA's economic development. The forecast for July is 97.2, which is lower than the previous month. In the previous month of June, consumer confidence was 98.7, which was below the forecast of 100.4. If the analyst expectations are missed again, this confirms the economic downturn in the USA. This development is likely to call the Federal Reserve back into action.

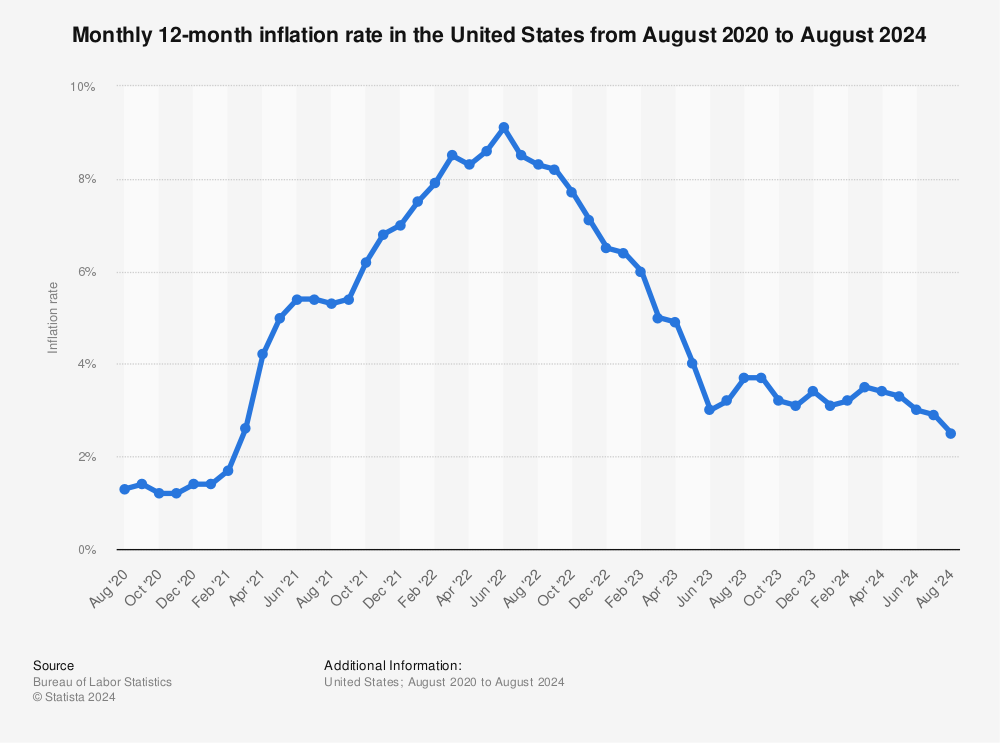

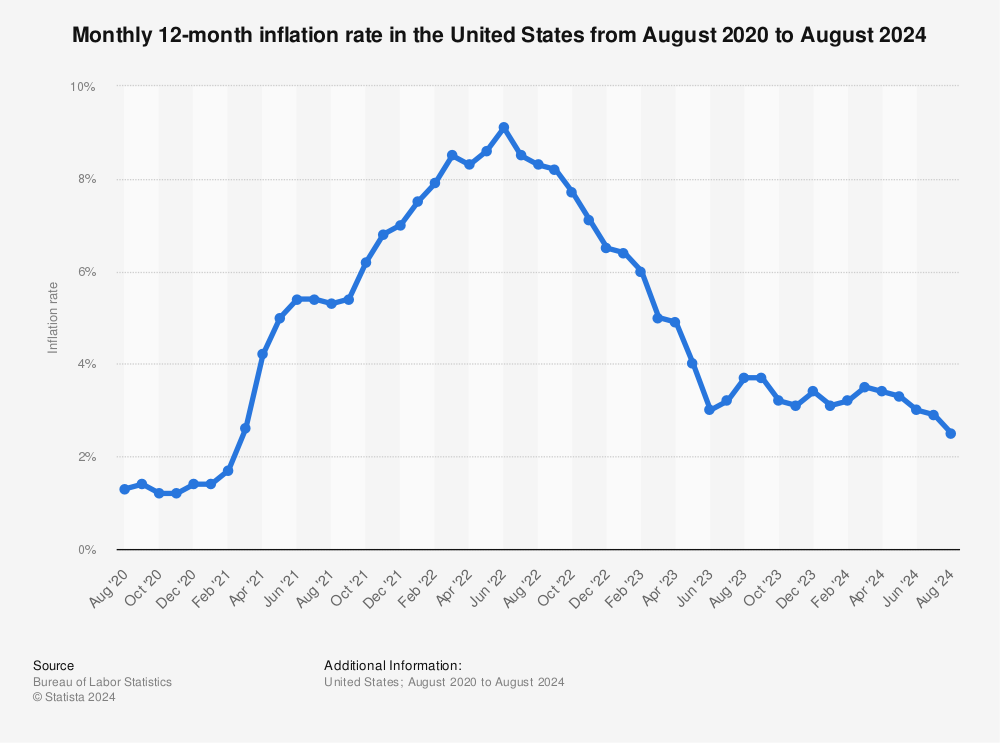

On Wednesday, July 27th, at 8:00 pm (CEST), the Fed's interest rate decision will be announced. The majority of analysts expect a 75 basis point interest rate hike to 2.50 percentage points. Due to a recently increased inflation rate of 9.1 percentage points in June, some key players now see a interest rate step of 100 to 125 basis points as justified.

The FOMC Statement, which will be released at the same time, will also provide valuable information about the economic and financial situation in the USA. At 8:30 pm (CEST), the press conference of Federal Reserve Chairman Jerome Powell will follow. Mr. Powell will answer journalists' questions about the US monetary policy.

The EU consumer prices and the PCE core rate are set to end the week on a high note. On Friday, July 29, the Consumer Price Index (CPI) for the month of July for the Eurozone will be released at 11:00 AM (CEST).

Market participants are predicting an increase over last year of 8.6 percentage points. The Consumer Price Index was already at 8.6 percent in the previous month of June. If the expert predictions are even surpassed this month, the pressure on the European Central Bank (ECB) will continue to intensify. ECB President Lagarde may be forced to raise interest rates again at the next rate decision in September, more than currently expected by market participants. In the afternoon, at 4:00 PM (CEST), the PCE core rate in the USA for the month of June will be announced. An increase over the previous month of 0.5 percentage points is expected.

Find more statistics at Statista

The core rate of private consumption expenditures (PCE) describes the change in the prices of goods and services that US consumers have purchased during the reporting period. The prices included in this price index exclude costs for food and energy. Changes in the PCE core rate indicate whether there is a continued inflation risk or whether the peak has been reached for now. For the US Federal Reserve, price pressure is a favored measure for assessing inflation risks in the USA.

If the core rate of private consumption expenditure exceeds expectations, a further appreciation of the US dollar can be expected. As expected, this is likely to have a negative impact on the development of the Bitcoin price.

In addition to the interest rate decision and relevant economic data such as the gross domestic product (GDP) of the USA and the consumer price index (CPI) for the Eurozone, the quarterly results of large US technology companies such as Meta and Alphabet will again be in focus this week. Whether the positive price development of the previous week will continue this trading week will again depend largely on economic data.

You can find out which dates could affect the prices of Bitcoin and Co. in this trading week in the following.

- The earnings reports

- US Consumer Confidence data

- Fed's interest rate decision

- Core rate of private consumption expenditures

The earnings reports of Microsoft and Alphabet (Google) on Tuesday will provide valuable insights into current demand in the information technology sector. In particular, the outlooks for the next set of earnings in the second half of the year will give clues about future global economic development. In the middle of the week, Zuckerberg's company Meta will open its books to investors.

Here too, investors are hoping for new insights into the scope of advertising placed on the various social media platforms of the company. On Thursday, Amazon will release its quarterly results. declining sales at the largest online retailer would also indicate an ongoing economic downturn.

The relevant fundamental data for the start of the week is the Consumer Confidence data from the USA. This data is used to reflect the optimism of consumers in the USA's economic development. The forecast for July is 97.2, which is lower than the previous month. In the previous month of June, consumer confidence was 98.7, which was below the forecast of 100.4. If the analyst expectations are missed again, this confirms the economic downturn in the USA. This development is likely to call the Federal Reserve back into action.

On Wednesday, July 27th, at 8:00 pm (CEST), the Fed's interest rate decision will be announced. The majority of analysts expect a 75 basis point interest rate hike to 2.50 percentage points. Due to a recently increased inflation rate of 9.1 percentage points in June, some key players now see a interest rate step of 100 to 125 basis points as justified.

The FOMC Statement, which will be released at the same time, will also provide valuable information about the economic and financial situation in the USA. At 8:30 pm (CEST), the press conference of Federal Reserve Chairman Jerome Powell will follow. Mr. Powell will answer journalists' questions about the US monetary policy.

The EU consumer prices and the PCE core rate are set to end the week on a high note. On Friday, July 29, the Consumer Price Index (CPI) for the month of July for the Eurozone will be released at 11:00 AM (CEST).

Market participants are predicting an increase over last year of 8.6 percentage points. The Consumer Price Index was already at 8.6 percent in the previous month of June. If the expert predictions are even surpassed this month, the pressure on the European Central Bank (ECB) will continue to intensify. ECB President Lagarde may be forced to raise interest rates again at the next rate decision in September, more than currently expected by market participants. In the afternoon, at 4:00 PM (CEST), the PCE core rate in the USA for the month of June will be announced. An increase over the previous month of 0.5 percentage points is expected.

Find more statistics at Statista

The core rate of private consumption expenditures (PCE) describes the change in the prices of goods and services that US consumers have purchased during the reporting period. The prices included in this price index exclude costs for food and energy. Changes in the PCE core rate indicate whether there is a continued inflation risk or whether the peak has been reached for now. For the US Federal Reserve, price pressure is a favored measure for assessing inflation risks in the USA.

If the core rate of private consumption expenditure exceeds expectations, a further appreciation of the US dollar can be expected. As expected, this is likely to have a negative impact on the development of the Bitcoin price.