Bitcoin investors distrust the current price movements

8/24/2022, 08:46 PM

The cryptocurrency market is highly volatile and ever-changing, making it difficult to predict what will happen next. However, data from blockchain analytics firm Glassnode can give us some insight into current market trends.

Bitcoin, the world's largest digital currency, saw its price surge to nearly $25,000 while small transactions were below $10,000, according to blockchain analytics firm Glassnode.

Bitcoin, the world's largest digital currency, saw its price surge to nearly $25,000 while small transactions were below $10,000, according to blockchain analytics firm Glassnode.

Transaction volume from retail investors did not increase when the key currency was trading at $24,400 due to a lack of interest from regular investors.

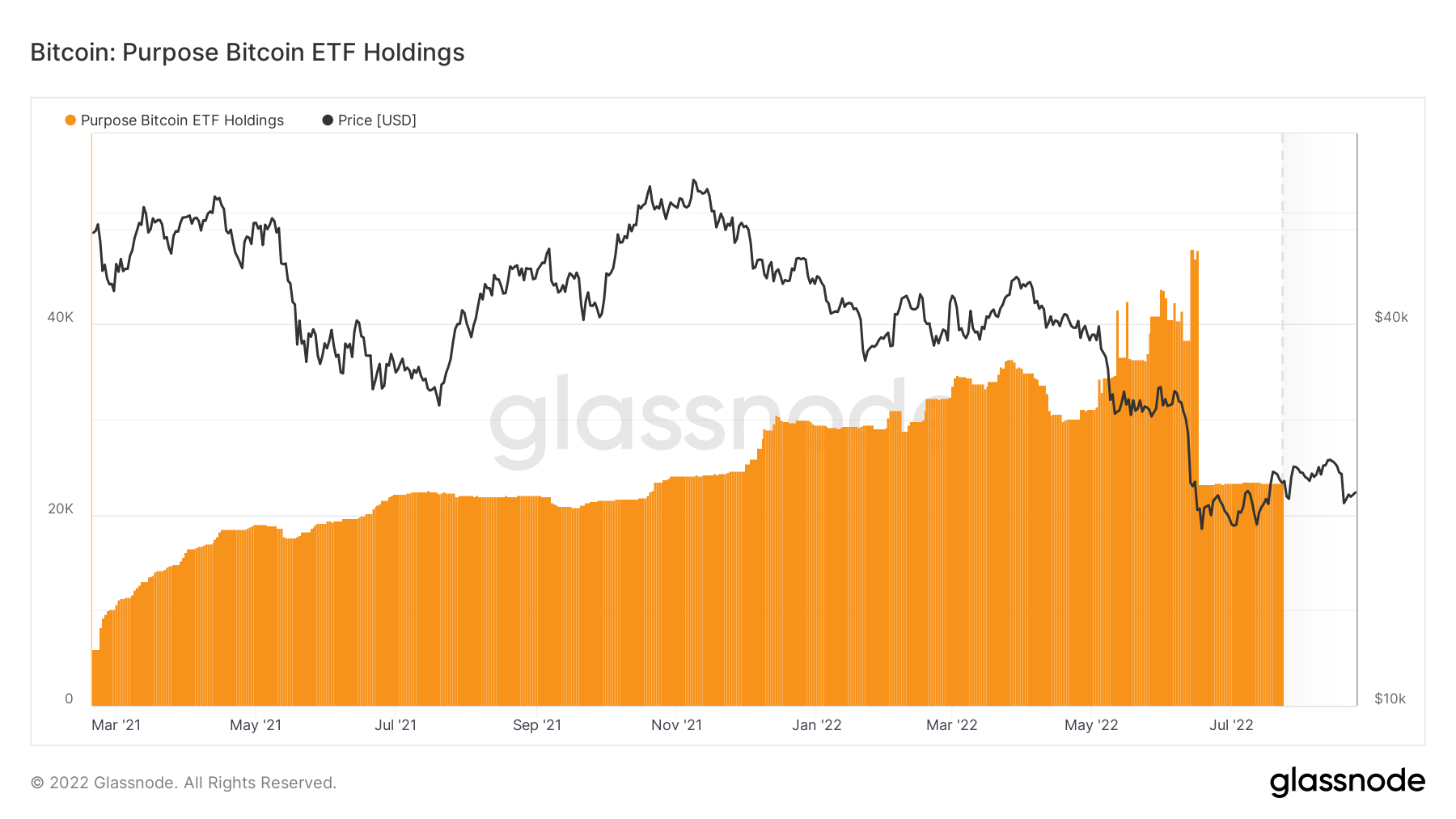

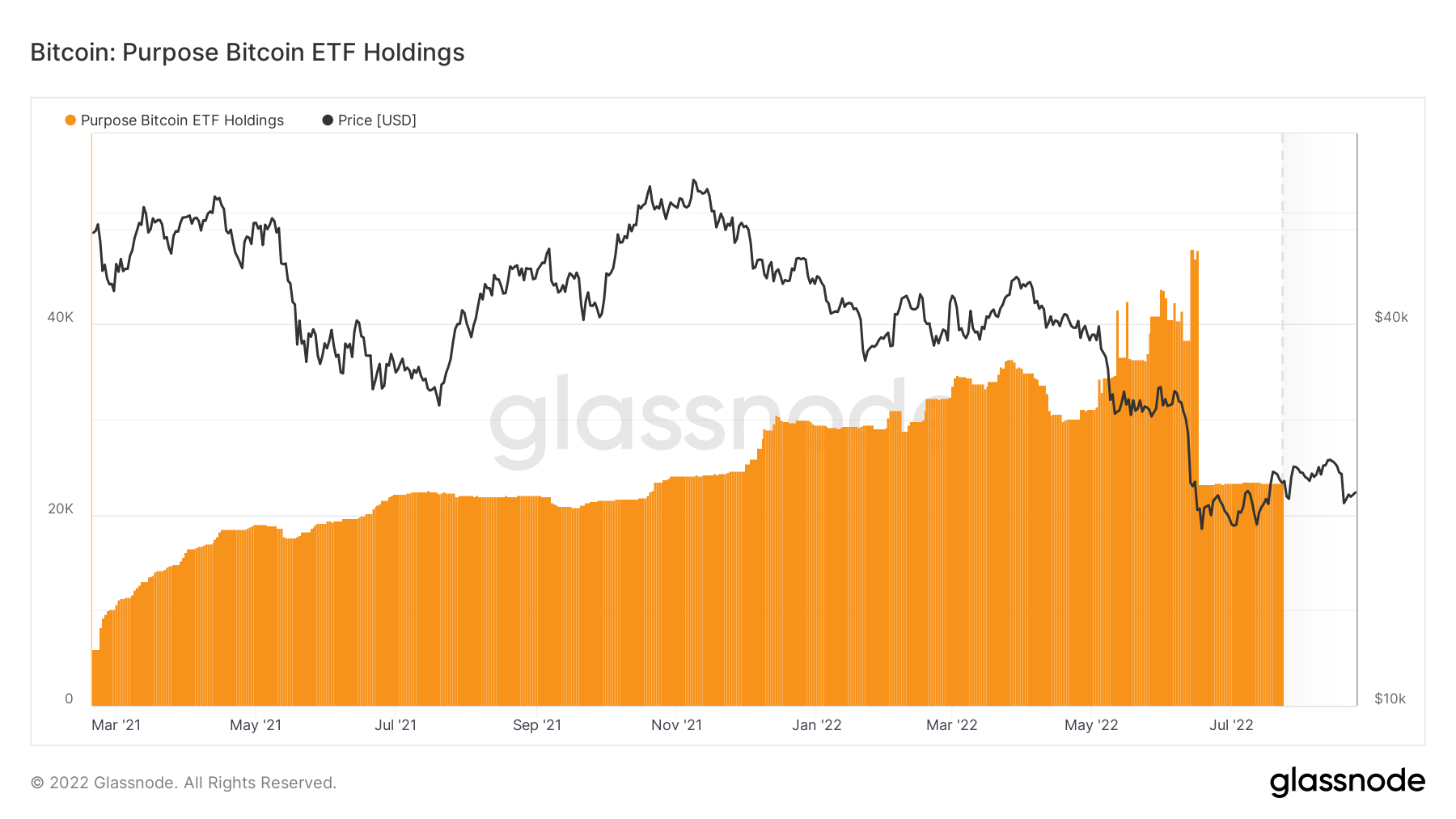

Glassnode also discusses inflows and outflows to cryptocurrency exchanges in the US, where there is a cyclical pattern indicated by the price of bitcoin relative to the US dollar.

Glassnode also discusses inflows and outflows to cryptocurrency exchanges in the US, where there is a cyclical pattern indicated by the price of bitcoin relative to the US dollar.

Should Investors sell immediately? Or is it worth joining PowerTap Hydrogen Capital? According to the blockchain analysis firm, exchange flows have hit a multi-year low as readings are comparable to those seen in late 2020.

This suggests that interest in Bitcoin is waning.

Glassnode data showing net realized gain/loss (90 DMA) shows that despite the turbulent market, sellers are still aggressive.

To confirm a recovery phase, the value for the net realized gain/loss (90DMA) should be close to neutral considering the previous bear cycles of 2018-19.

The ratio between the sale price and the investors' purchase price is known as the SOPR. Glassnode analyzed the SOPR of short-term holders at the close of the survey (90DMA). The key number in this case is one. If the value is higher than one, this indicates lucrative spending.

Following November 2021 data, during Bitcoin (ATH) all-time high, short-term holders (top buyers) suffered significant losses. This caused the short-term holders SOPR (90DMA) to fall below one.

This is the point where there is little conviction and resistance will come at a breakeven of one.

Bitcoin, the world's largest digital currency, saw its price surge to nearly $25,000 while small transactions were below $10,000, according to blockchain analytics firm Glassnode.

Bitcoin, the world's largest digital currency, saw its price surge to nearly $25,000 while small transactions were below $10,000, according to blockchain analytics firm Glassnode.Transaction volume from retail investors did not increase when the key currency was trading at $24,400 due to a lack of interest from regular investors.

Glassnode also discusses inflows and outflows to cryptocurrency exchanges in the US, where there is a cyclical pattern indicated by the price of bitcoin relative to the US dollar.

Glassnode also discusses inflows and outflows to cryptocurrency exchanges in the US, where there is a cyclical pattern indicated by the price of bitcoin relative to the US dollar.Should Investors sell immediately? Or is it worth joining PowerTap Hydrogen Capital? According to the blockchain analysis firm, exchange flows have hit a multi-year low as readings are comparable to those seen in late 2020.

This suggests that interest in Bitcoin is waning.

Glassnode data showing net realized gain/loss (90 DMA) shows that despite the turbulent market, sellers are still aggressive.

To confirm a recovery phase, the value for the net realized gain/loss (90DMA) should be close to neutral considering the previous bear cycles of 2018-19.

The ratio between the sale price and the investors' purchase price is known as the SOPR. Glassnode analyzed the SOPR of short-term holders at the close of the survey (90DMA). The key number in this case is one. If the value is higher than one, this indicates lucrative spending.

Following November 2021 data, during Bitcoin (ATH) all-time high, short-term holders (top buyers) suffered significant losses. This caused the short-term holders SOPR (90DMA) to fall below one.

This is the point where there is little conviction and resistance will come at a breakeven of one.